The Importance of Yield in Creating a Portfolio

When I create or analyze a portfolio for my clients, I look at several factors in determining its suitability:

- Volatility / Beta

- Diversification / Asset Allocation

- Stock Intersection

- Yield

- Risk to Return ratio

In this article we’ll be examining the concept of YIELD.

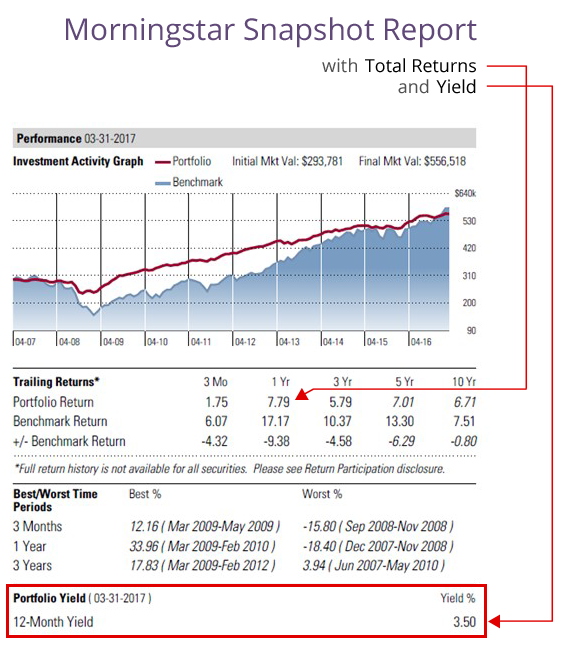

Yield is most commonly defined as a measure of “liquid returns” or income received while holding an investment. It can consist of dividends and interest and is paid to you monthly, quarterly, or annually. Return, on the other hand, consists of yield plus any capital appreciation or loss you get when you finally sell the stock or bond. Yield might even be used to describe the rent payments you receive on a rental property, or other income that comes to your pocket even when the investment itself might be going down in value.

Although capital appreciation is a real part of your return, since I’m a conservative investor, I tend to look at yield as the most healthy part of your return. In other words, I don’t get as excited about the fact that Apple is going up in value as much as I am about any dividends it might be paying.

To me, a return of profits in the form of dividends is the whole reason why stocks were invented in the first place. Shares used to be priced at a P/E ratio of 10-12, i.e. the price for the stock was about 10-12 times the earnings. The notion was that an investor would be getting a 10% return on their investment each year (roughly) by sharing in the profits of the company they were helping to build with their capital.

Nowadays, capital appreciation, day trading, options, and speculation are more glamorous and desirable than good old-fashioned dividends and interest. Yield is smaller, slower, and predictable, while capital appreciation can be larger and sometimes wildly profitable, with Facebook-type IPOs giving investors a crazy return on their investment almost overnight. Becoming rich fast is a lot more exciting to strive for than a slow, steady return of real earnings a company doles out over the years.

For those in their 20s and 30s, there is also the feeling that they have many years to invest and can take bigger risks with lower yielding, more aggressive growth stocks or bonds. But as one gets older, safety of principal becomes more important. In addition, for those who are retired, sometimes they need a monthly income to supplement their pensions or social security, and liquid yield can make up the gap.

What is a good yield to strive for? As mentioned, it depends on your goals, investment time horizons, and risk tolerance. Rather than target an absolute yield number, I usually use it to compare one portfolio against another. So if everything else in the portfolios are similar — beta, diversification, Sharpe ratio — I might use a higher yield as the tie-breaker. If my client is young and doesn’t need the dividends and interest to spend, we simply reinvest them back into the markets. But knowing that they are receiving them in the first place is a good indication of a healthy portfolio that is not completely dependent on a sale of the investment to realize gains.

Subscribe

to our Newsletter

Financial PlanningArticles

That is the question! . . . Can I get a tax deduction for my Home Office? Even if you are eligible to take a tax deduction for your home office, there are times it is not worth doing so. Why? . . . Why can't I just hire aFinancial Planner? How do you know who to hire? When you do hire someone, how do you know that they are doing a good job? What happens if . . . The